Loading

Get Form 12508

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12508 online

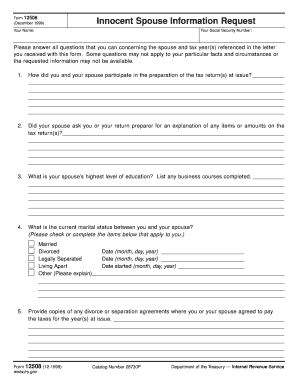

Filling out the Form 12508 can be straightforward with the right guidance. This document is an Innocent Spouse Information Request form that helps provide the necessary information regarding tax matters. Follow this guide for step-by-step instructions on completing the form online.

Follow the steps to successfully complete the Form 12508 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your name in the designated field. Ensure the spelling is accurate as it must match your official records.

- Answer the first question regarding your and your spouse's participation in the preparation of the tax returns. Provide as much detail as possible to clarify your involvement.

- Move on to the second question about whether your spouse requested any explanations about the tax returns. Be specific about any interactions related to this inquiry.

- For the third question, indicate your spouse’s highest educational level and any relevant business courses completed.

- Provide information about your current marital status. Check the applicable box or complete the necessary fields with accurate dates to reflect your relationship status.

- If applicable, include copies of divorce or separation agreements that relate to the tax responsibilities for the year(s) in question.

- Answer the question about your joint or separate bank accounts. List the types of accounts and institutions involved.

- Discuss your arrangements regarding household finances and bill payments in the suggested section.

- Elaborate on how taxes were intended to be paid if they were not settled at the time of filing. Indicate if your spouse was informed of this plan.

- If there was an audit, specify any changes to the return items and clarify if those changes pertained to you or your spouse.

- Finally, if any assets were transferred between you and your spouse after the tax years in question, describe the transfers and list the dates. Include reasons for these transfers.

- After completing all sections, review your responses for accuracy. Once confirmed, save your changes, and consider downloading, printing, or sharing the form as needed.

Complete your Form 12508 online today to ensure your tax matters are handled efficiently.

Form 10IEA can be accessed directly from the IRS or through tax preparation software that supports IRS forms. This form is necessary for certain income reporting. It is beneficial to utilize comprehensive platforms like uslegalforms, which condense the retrieval process. They provide easy access and detailed instructions for filling out this form correctly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.