Loading

Get Form 8822 Turbotax Fill In

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8822 Turbotax Fill In online

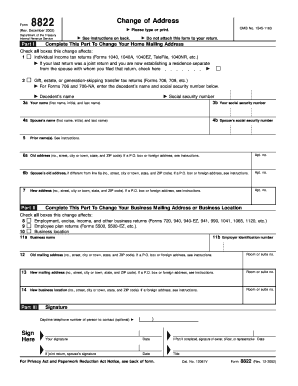

Filling out Form 8822 is essential for notifying the Internal Revenue Service of a change in your mailing address, whether for personal or business purposes. This guide will provide you with a clear, step-by-step process to fill out the form online, ensuring you can make the necessary updates efficiently.

Follow the steps to fill out Form 8822 seamlessly.

- Press the ‘Get Form’ button to access the Form 8822 and open it in your preferred editor.

- Begin filling out Part I to change your home mailing address. Specify which changes apply to you by checking the appropriate boxes. You can indicate if the change affects your individual income tax returns, gift tax returns, or if it relates to joint filing.

- Provide your name as it appears on tax documents in line 3a. If applicable, include your spouse's name in line 4a. Make sure to provide any prior names in line 5.

- Enter your old address in line 6a, ensuring you include the complete information: house number, street name, city, state, and ZIP code. If you are using a P.O. box or a foreign address, follow the instructions provided.

- If your spouse has a different address, enter it in line 6b.

- In line 7, input your new address, including any apartment or suite number. Make sure this format is consistent with your previous entries.

- Complete Part II only if you are changing your business mailing address or business location. Again, indicate which changes apply by checking the boxes in the respective section.

- Fill in lines 11a and 11b with your business name and employer identification number.

- Provide both your old and new mailing addresses in the respective lines in Part II, as you did in Part I for your personal address.

- Sign and date the form where indicated, ensuring that all information is accurate. If this is a joint return, your spouse should also sign.

- Review all entries for completeness and accuracy. Once satisfied, save changes, download, or print the form for your records.

Start filling out your Form 8822 online now to ensure your address updates are processed promptly.

You can find Form 8822 on the IRS website or by using TurboTax, which offers an easy fill option for this form. Simply navigate to the appropriate section in TurboTax to access the Form 8822 Turbotax Fill In feature. This functionality streamlines the process, making it straightforward to complete your forms without hassle.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.