Get Form 8820

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8820 online

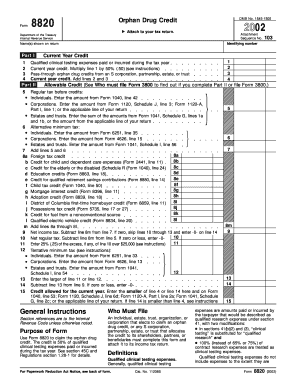

Filling out Form 8820 is an essential step for individuals and organizations looking to claim the orphan drug credit. This guide will walk you through each section of the form, providing clear and straightforward instructions to help you complete it accurately online.

Follow the steps to complete Form 8820 online effectively.

- Press the ‘Get Form’ button to access the form and open it for editing.

- Provide your name and any partners' names on the lines specified at the top of the form. Ensure accuracy as this will be attached to your tax return.

- Move to Part I where you will list any qualified clinical testing expenses paid or incurred during the tax year. Fill in line 1 with the amount of your expenses, then proceed to multiply this total by 50% (0.50) and enter the result on line 2.

- If you are receiving any pass-through orphan drug credits from an S corporation, partnership, estate, or trust, enter that amount on line 3. Sum lines 2 and 3 to find your current year credit, which you will note on line 4.

- In Part II, input the relevant identifying information including the allowable credits as required. Complete the section on regular tax before credits based on your return type—individual, corporation, or trust. Input the appropriate figure as directed.

- Follow through the subsequent lines, noting any credits you may qualify for, such as child tax or education credits, totaling them in the specified lines.

- Calculate your net income tax by subtracting line 8m from line 5, then move to find the current year credit allowed on line 14, ensuring you adhere to any limits based on your tax liability.

- Review each completed section for accuracy. Once satisfied, you can save your changes, then download, print, or share your completed Form 8820 as necessary.

Start filling out your Form 8820 online today to claim your orphan drug credit!

The CA employee tax withholding form is used by employers to calculate the amount of state income tax that should be withheld from employees’ paychecks. This form ensures compliance with California tax laws and helps employees manage their tax obligations. Employers must provide accurate information to avoid under-withholding, which could lead to penalties. For guidance on completing this form, take advantage of resources available at US Legal Forms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.