Loading

Get Irs 990 - Schedule R 2022-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule R online

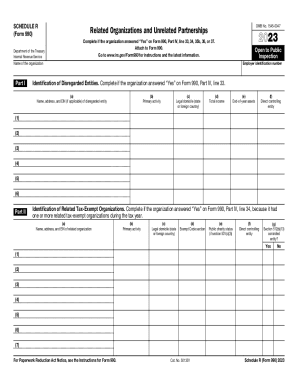

The IRS 990 - Schedule R is a critical document for organizations to report their related organizations and partnerships. This guide provides a clear, step-by-step approach to filling out the form online, ensuring users understand each component and requirement.

Follow the steps to accurately complete Schedule R.

- Press the ‘Get Form’ button to retrieve the IRS 990 - Schedule R form and open it in your editor.

- Begin with Part I, where you will need to identify any disregarded entities. Fill out the requested information such as name, address, and Employer Identification Number (EIN) if applicable, along with details about primary activity and financials.

- Move to Part II, which focuses on identifying related tax-exempt organizations. Enter the necessary information for each organization, including EIN and primary activities, while also specifying their legal domicile and exempt code section.

- Proceed to Part III, where you will identify related organizations that are taxable as partnerships. This part requires comprehensive reporting of the organization’s activities and their financial contributions.

- In Part IV, continue with organizations that are taxable as corporations or trusts. Similar to previous sections, provide the relevant details, including their activities and financial stakes.

- Skip to Part V to disclose transactions with related organizations. Indicate any transactions that occurred during the year and provide the name of the related organization involved along with the transaction type and amounts.

- Complete Part VI if applicable, which requires information about unrelated organizations that are taxed as partnerships. Provide details on these entities, their primary activities, and income.

- Finally, fill out Part VII for any supplemental information that might clarify responses in earlier sections. Be thorough and clear.

- Once all sections are completed, save your changes. You can then download, print, or share the completed form as needed.

Start filling out the IRS 990 - Schedule R online to ensure your organization complies with federal reporting requirements.

Abstract: Form 941 is used by employers to report payments made to employees subject to income and social security/Medicare taxes and the amounts of these taxes. Form 941-PR is used by employers in Puerto Rico to report social security and Medicare taxes only.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.