Get Certificate Of Discharge From Federal Tax Lien Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate of Discharge From Federal Tax Lien Form online

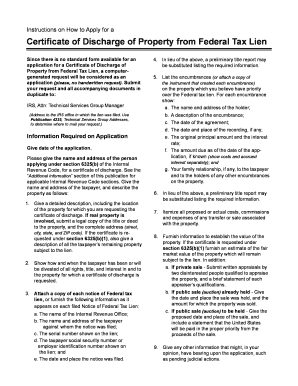

Filling out the Certificate of Discharge From Federal Tax Lien Form online can seem complex, but this guide is designed to simplify the process. Follow these instructions step-by-step to ensure that your application is completed accurately and effectively.

Follow the steps to successfully complete the form online.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by filling in the date of your application. This is essential for record-keeping and tracking the status of your request.

- Provide your full name and address as the applicant. Ensure that you are compliant with section 6325(b) of the Internal Revenue Code.

- Detail the name and address of the taxpayer associated with the federal tax lien. Include a comprehensive description of the property, stating its location and any legal documentation required, such as the title or deed.

- Clearly articulate how and when you or the taxpayer will divest all rights, title, and interest in the property for which you request the discharge certificate.

- Attach a copy of each notice of federal tax lien, or provide the required details as they appear on each filed notice, including the name of the Internal Revenue office and the taxpayer's identification.

- List any encumbrances on the property that you believe have priority over the federal tax lien. Include the name and address of the holder along with relevant descriptions and financial details.

- Itemize all proposed or actual costs, commissions, and expenses related to the transfer or sale of the property.

- Provide an estimate of the fair market value of the property that will remain subject to the lien, including supporting documentation such as appraisals from two disinterested appraisers, if applicable.

- Supply any additional information that you believe could impact the application, such as pending legal actions.

- Review all provided information for accuracy and completeness, including the signature declaration indicating that your application is true to the best of your knowledge.

- Finally, save your changes and ensure that the document is downloaded or printed as necessary. Share it with the required IRS office in duplicate.

Start completing your Certificate of Discharge From Federal Tax Lien Form online today!

A lien discharge refers to the official release of a lien from your property, which enables you to regain full ownership without any encumbrances. When you complete and submit a Certificate Of Discharge From Federal Tax Lien Form, it informs the IRS of your request to remove the tax lien. Receiving a lien discharge can significantly enhance your credit standing and simplify property transactions. Understanding this process is essential for maintaining your financial freedom.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.