Loading

Get Form 8832 Rev 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8832 Rev 2003 online

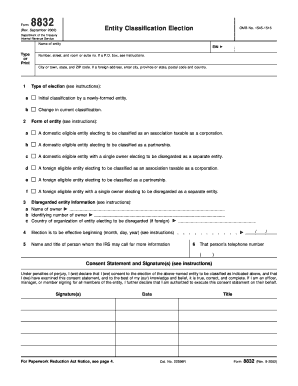

Filling out Form 8832 Rev 2003 is essential for entities looking to elect their classification for Federal tax purposes. This guide will provide clear and structured instructions to help you complete the form efficiently and accurately.

Follow the steps to fill out Form 8832 Rev 2003 online.

- Click 'Get Form' button to access and open the form in your editor.

- Enter the name of the entity electing classification. Ensure it matches the registered name used in official documents.

- Provide the Employer Identification Number (EIN) for the entity. If the entity does not have an EIN, apply for one through the appropriate process.

- Fill in the address of the entity, including the street number, room or suite number, city, state, and ZIP code. If a P.O. box is used, make sure to include it correctly.

- Select the type of election you are making by checking box 1a for an initial classification or box 1b for a change in current classification.

- Check the appropriate box under line 2 to indicate the form of entity classification (e.g., corporation, partnership, or disregarded entity).

- If applicable, enter the owner's name and identifying number if you are electing to be disregarded as a separate entity. Ensure you specify the country of organization for foreign entities.

- Indicate the effective date for the election on line 4. Ensure this date adheres to the 75-day rule concerning prior and future filing.

- Complete the Consent Statement and Signature section. Ensure that it is signed by all appropriate individuals authorized to consent on behalf of the entity.

- After completing the form, review all entries for accuracy. Save your changes, then download, print, or share the completed form as needed.

Complete your Form 8832 online to ensure accurate classification and compliance with IRS requirements.

An LLC that is not automatically classified as a corporation and does not file Form 8832 will be classified, for federal tax purposes under the default rules. An LLC that has one member will be classified as a “disregarded entity.” A disregarded entity is one that is disregarded as an entity separate from its owner.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.