Loading

Get Form 8827

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8827 online

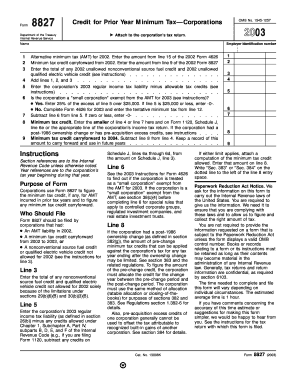

Form 8827 is used by corporations to calculate their minimum tax credit for excess alternative minimum tax incurred in previous years. This guide will provide you with a clear and systematic approach to completing the form online.

Follow the steps to complete the Form 8827 accurately

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the corporation's name and employer identification number in the designated fields. Ensure that both entries are accurate as they are crucial for the submission.

- For line 1, input the alternative minimum tax amount from line 15 of the 2002 Form 4626. This amount reflects past liabilities that will affect your current calculations.

- Line 2 requires you to enter the minimum tax credit carryforward from 2002. Refer to line 9 from the previous year’s Form 8827 for the correct figure.

- In line 3, calculate and enter the total of any 2002 unallowed nonconventional source fuel credit and unallowed qualified electric vehicle credit. Make sure to follow the specific instructions to determine the correct total.

- Add lines 1, 2, and 3 together in line 4. This total is important as it will help you determine the eligible credits for this tax year.

- For line 5, calculate the corporation’s 2003 regular income tax liability minus any allowable tax credits. Accurate calculation in this step is important for determining AMT liability.

- Complete line 6 by determining whether the corporation qualifies as a small corporation exempt from AMT based on the previous year’s rules. Enter the appropriate figure based on your findings.

- Subtract line 6 from line 5 on line 7. If this results in zero or less, enter -0. This figure affects the final minimum tax credit calculation.

- On line 8, enter the smaller of line 4 or line 7, which is the minimum tax credit eligible for your corporation. This figure should also be input on Form 1120, Schedule J, line 6e or the corresponding line of the corporation’s tax return.

- Finally, for line 9, calculate the minimum tax credit carryforward to 2004 by subtracting line 8 from line 4. Keep a record of this amount for future reference.

- Once all fields are completed, review your entries for accuracy. You can then save changes, download, print, or share the form as required.

Complete your Form 8827 online today to ensure accurate filing and compliance with tax regulations.

The easiest way to obtain copies of your tax returns is to request them directly from the IRS. You can also use services like US Legal Forms, which can simplify the process for you. They offer guidance on how to access your tax documents, including details that may be outlined in Form 8827.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.