Loading

Get 2022 Form Irs 1095-c Fill Online, Printable, Fillable, Blank ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the 2022 Form IRS 1095-C Fill Online, Printable, Fillable, Blank ... online

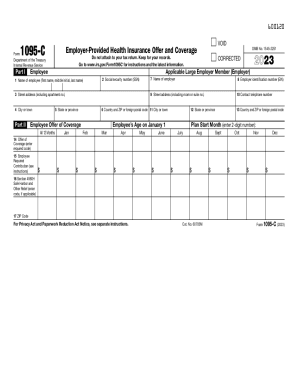

The 2022 Form IRS 1095-C is an important document used to report health coverage offered by your employer. This guide provides comprehensive instructions to assist you in completing the form accurately and efficiently.

Follow the steps to successfully fill out the 2022 Form IRS 1095-C.

- Click 'Get Form' button to obtain the form and open it for editing.

- In Part I, fill in your personal information. This includes your name, social security number, and address. Ensure all details are accurate to avoid issues later.

- Complete the employer information in Part I. Enter your employer's name, identification number (EIN), and contact information to provide a full context of your coverage.

- Move on to Part II, where you will report the offer of coverage details. Select the correct code from the provided list that represents the health coverage offered to you.

- In this section, also enter the employee required contribution, which is the monthly cost for the lowest cost self-only minimum essential coverage offered by your employer.

- If applicable, provide information in line 16 regarding safe harbor codes related to the employer shared responsibility provisions.

- In Part III, if your employer provided self-insured coverage, enter the names and social security numbers of individuals covered under the plan. Indicate the months of coverage for each person listed.

- Review all entries on the form for accuracy. It is crucial that you ensure every field is filled out correctly to prevent any potential complications with your tax return.

- Once you have completed the form, you can save your changes, download the document, print it for your records, or share it as needed.

Start filling out your 2022 Form IRS 1095-C online today to ensure you're prepared for tax season!

This Form 1095-C includes information about the health insurance coverage offered to you by your employer. Form 1095-C, Part II, includes information about the coverage, if any, your employer offered to you and your spouse and dependent(s).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.