Loading

Get Form 4562 2003

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4562 2003 online

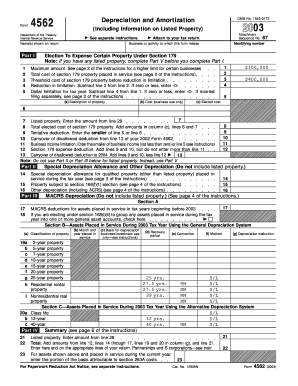

Filling out Form 4562 for the year 2003 involves various sections that detail depreciation and amortization for business property. This guide will provide a step-by-step approach to assist you in completing this form accurately and efficiently online.

Follow the steps to accurately complete Form 4562 online.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- Input your name(s) as shown on your return in the designated fields at the top of the form. Make sure it matches your tax return information.

- Identify the business or activity related to this form by providing the name of the business and the identifying number.

- In Part I, complete the election to expense certain property under Section 179. Begin by entering the maximum amount and the total cost of Section 179 property placed in service.

- Continue through Part I, calculating and entering the additional necessary figures, such as the threshold cost and reductions in limitation based on your totals.

- Proceed to Part II to enter any special depreciation allowances applicable to your qualified property placed in service during the tax year.

- Next, fill out Part III with depreciation deductions for assets placed in service during the tax year using the MACRS depreciation method.

- In Part IV, summarize depreciation and amortization results, adding any necessary totals as specified in the instructions.

- If needed, complete Part V for listed property, ensuring all vehicle and percentage use fields are accurately filled.

- Finally, review all entries for accuracy. Once satisfied, save your changes, download to keep a copy, print for physical records, or share the completed form as required.

Start filling out your Form 4562 online to ensure accurate reporting of your depreciation and amortization.

Form 4562 is used primarily for claiming deductions for depreciation and amortization of assets, as well as for the Section 179 expense deduction. It helps taxpayers accurately report these expenses, ensuring they take full advantage of their allowable tax benefits. With the right knowledge of Form 4562 2003, you can potentially enhance your tax position significantly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.