Loading

Get Irs Form 3621

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 3621 online

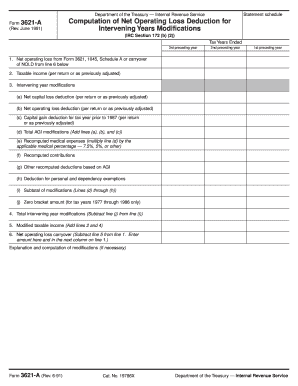

Filling out IRS Form 3621 is essential for individuals managing their net operating loss deductions effectively. This guide will provide you with a comprehensive step-by-step process to fill out this form online with clarity and confidence.

Follow the steps to complete IRS Form 3621 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the tax years for which you are filing in the designated sections, labeled as the 3rd preceding year, 2nd preceding year, and 1st preceding year.

- Input the net operating loss from Form 3621, 1045, Schedule A, or the carryover of net operating loss deduction (NOLD) from line 6.

- Record your taxable income as reported on your return or as previously adjusted in the appropriate field.

- For intervening year modifications, fill in the following sections: (a) net capital loss deduction, (b) net operating loss deduction, (c) capital gain deduction for tax years prior to 1987, and (d) total AGI modifications by adding lines (a), (b), and (c).

- Calculate recomputed medical expenses by multiplying the total AGI modifications from line (d) by the applicable medical percentage, which may be 7.5%, 5%, or another rate.

- List recomputed contributions in the next available field and detail any other recomputed deductions based on AGI.

- Include deduction for personal and dependency exemptions as applicable.

- Compute the subtotal of modifications, which includes lines (d) through (h).

- If applicable, note the zero bracket amount for tax years from 1977 through 1986 in the designated space.

- Calculate total intervening year modifications by subtracting the zero bracket amount (line j) from the subtotal of modifications (line i).

- Determine modified taxable income by adding the total intervening year modifications (line 4) to the taxable income (line 2).

- Finally, calculate the net operating loss carryover by subtracting the modified taxable income from the net operating loss provided initially. Enter this amount on line 1 in the next column.

- Once you are finished, save changes, download, print, or share the completed form as needed.

Complete your IRS Form 3621 online today to ensure accurate filing.

You can find Form 3921 on the IRS website under the Forms and Publications section. This site offers a wealth of resources to help you locate and download the necessary forms, including Irs Form 3621. If you prefer a more simplified approach, uslegalforms offers a user-friendly platform to access and manage your legal forms effortlessly.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.