Get Free Indiana Tax Power Of Attorney Form (form 49357)pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Free Indiana Tax Power Of Attorney Form (Form 49357)PDF online

Filling out the Free Indiana Tax Power Of Attorney Form (Form 49357) can seem complex, but this guide will clarify each step. By following these instructions, you can effectively complete the form online, ensuring your taxpayer representation is properly authorized.

Follow the steps to complete the form with ease.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

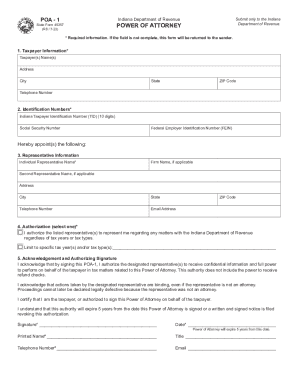

- Enter taxpayer information in the first section. Fill in the names, address, city, state, ZIP code, and telephone number of the taxpayer(s). Ensure all fields marked with an asterisk (*) are completed as they are required.

- In the second section, provide the identification numbers. Enter the Indiana Taxpayer Identification Number, Social Security Number, and Federal Employer Identification Number where applicable.

- Fill out the representative information by providing the name of the individual representative and firm name if applicable. Include the address, city, state, ZIP code, telephone number, and email address of the representative(s).

- Select your authorization preference. You can authorize the representative to handle all tax matters or limit it to specific tax years or types. If limiting, clearly specify the relevant tax year(s) and/or tax type(s).

- Complete the acknowledgment section. Sign the form, insert the date, and include your printed name and title. You must also provide a telephone number and email. Note that the form is valid for five years unless revoked.

- After filling out all required fields, review the information for accuracy. Save your changes, then download, print, or share the form as needed.

Take the next step and complete the necessary documents online for your tax representation.

Get form

An Indiana tax power of attorney (Form 49357), otherwise known as Indiana Department of Revenue Power of Attorney, is a type of hardcopy appointment that allows a person to delegate to another person the handling of your tax matters with the Department of Revenue. Indiana Tax Power of Attorney (Form 49357) - eForms eForms https://eforms.com › Power of Attorney › Indiana eForms https://eforms.com › Power of Attorney › Indiana

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.