Loading

Get Form 12277

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12277 online

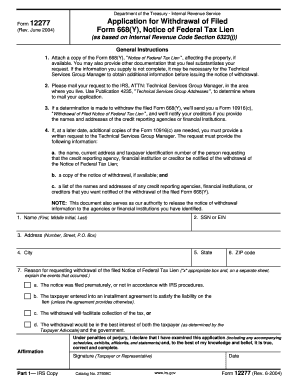

Filling out Form 12277 is an essential step for individuals seeking withdrawal of a previously filed Notice of Federal Tax Lien. This guide will provide you with comprehensive instructions on how to complete the form accurately and efficiently online.

Follow the steps to complete Form 12277 successfully.

- Click ‘Get Form’ button to access the form and open it in your preferred digital editor.

- In Section 1, enter your Social Security Number (SSN) or Employer Identification Number (EIN) in the designated field.

- Provide your full name, including your first name, middle initial, and last name in the appropriate fields.

- Fill out your address, ensuring you include your house number, street name, and any P.O. Box details.

- Select your state from the dropdown menu, then enter your city and ZIP code in the respective fields.

- In Section 7, mark the box that corresponds to your reason for requesting the withdrawal of the Notice of Federal Tax Lien, and provide an explanation on a separate sheet if required.

- Complete the affirmation part by signing the form, either as the taxpayer or as a representative, and include the date of signing.

- After completing all fields, review your information for accuracy. Once verified, save your changes, and you can choose to download, print, or share the form as needed.

Take the next step and complete your Form 12277 online today.

To look up an Ohio state tax lien, you can access the Ohio Secretary of State's website for public records. You can search for liens by entering the name of the individual or entity involved. Additionally, using Form 12277 to manage your tax obligations may prevent future liens from occurring. Tools and resources available on the US Legal Forms platform can also assist you in finding information related to tax liens.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.