Loading

Get 2005 Schedule B Form 8836

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2005 Schedule B Form 8836 online

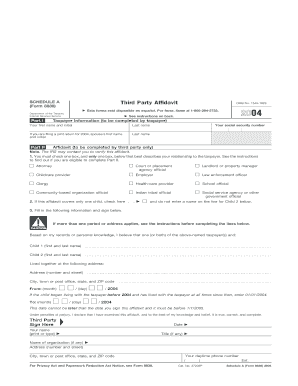

Filling out the 2005 Schedule B Form 8836 is essential for qualifying children residency statements. This guide provides step-by-step instructions to help you complete the form accurately and efficiently online.

Follow the steps to successfully complete your 2005 Schedule B Form 8836.

- Click ‘Get Form’ button to access the 2005 Schedule B Form 8836 and open it in your preferred online editing tool.

- Begin filling out the taxpayer information section. Enter your first name, middle initial, last name, and social security number in the appropriate fields.

- If applicable, provide your spouse's first name, middle initial, last name, and social security number for joint return filing.

- Complete Part I by ensuring that all sections regarding the qualifying child or children are filled out accurately.

- In Part II, have the designated third party complete their section as applicable. This includes their relationship to you and any details about your qualifying child.

- Ensure that the third party's affidavit is fully filled in and signed. Double-check that all required information is accurate, including any periods of residence.

- Review the completed form for any errors or omissions before finalization.

- Once satisfied with the information entered, save any changes made to the form. You may then download, print, or share the form as needed.

Complete your documents online today to ensure timely and accurate submissions.

Currently, IRS form 8822-b cannot be submitted online. It's necessary to print and mail the form to the IRS. However, for any related forms, including the 2005 Schedule B Form 8836, you can utilize US Legal Forms to ensure you follow the correct submission procedures with ease.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.