Get 2004 Form 8606

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 Form 8606 online

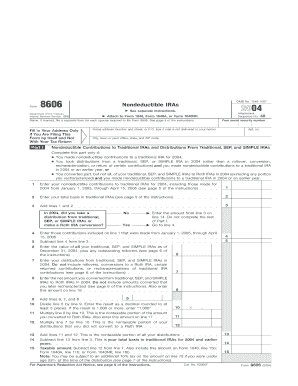

Filling out the 2004 Form 8606 is essential for reporting nondeductible contributions to traditional IRAs and Roth IRA conversions. This guide provides step-by-step instructions to help users complete the form online with ease.

Follow the steps to successfully complete your Form 8606 online.

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Fill in your personal information, including your name, address, and social security number. If you are married, remember to complete a separate form for your spouse.

- In Part I, enter any nondeductible contributions you made to traditional IRAs for the year 2004, including those made between January 1, 2005, and April 15, 2005.

- Record your total basis in traditional IRAs on line 2. This represents the total amount you have contributed that is non-deductible.

- Add the amounts from line 1 and line 2 on line 3 to determine your total nondeductible contributions.

- Answer the question regarding distributions from traditional, SEP, or SIMPLE IRAs. If applicable, continue filling out the remainder of Part I.

- Follow the instructions related to converting from traditional IRAs to Roth IRAs, if this pertains to your situation. Fill out the relevant calculations in Part II.

- If you had distributions from Roth IRAs, complete Part III to detail these transactions.

- Review all entered information for accuracy. Make any necessary edits before finalizing your form.

- Once completed, you can save changes, download, print, or share the form as needed.

Start filling out your Form 8606 online to report your contributions and conversions accurately.

Filing the 2004 Form 8606 for previous years involves retrieving the specific form for the year in question from the IRS website. Complete the form accurately, ensuring all prior contributions and distributions are accounted for. Afterward, submit it with your amended tax return or as a separate submission depending on the year. If you find it overwhelming, consider using platforms like US Legal Forms that provide guidance and templates to make this process easier for you.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.