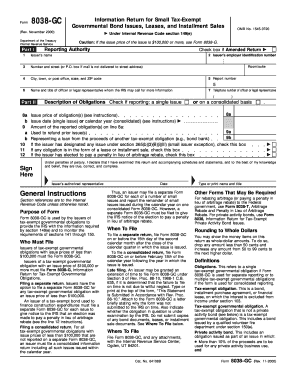

Get Form 8038-gc (rev. November 2000). Information Return For Small Tax-exempt Governmental Bond

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8038-GC (Rev. November 2000). Information Return For Small Tax-Exempt Governmental Bond online

Filling out the Form 8038-GC is essential for issuers of tax-exempt governmental obligations to report necessary information to the IRS. This guide provides clear, step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Form 8038-GC correctly

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In Part I, provide reporting authority information. Enter the issuer’s name in line 1, ensuring it is the entity issuing the obligations. In line 2, input the issuer’s employer identification number (EIN) or write 'Applied for' if the EIN is not obtained yet.

- Complete the address fields in lines 3 and 4, including the number, street, city, state, and ZIP code. In line 5, enter a self-designated report number for tracking purposes.

- Identify the officer or legal representative in lines 6 and 7, providing their name, title, and telephone number for IRS inquiries.

- In Part II, check if you are reporting a single issue or on a consolidated basis. Enter the issue price of obligations in line 8a and the issue date or calendar year in line 8b.

- For lines 9a and 9b, indicate if any portion of the proceeds will be used to refund prior issues or represent a loan from proceeds of another tax-exempt obligation.

- If applicable, check the boxes in lines 10, 11, and 12 to report information related to small issuer exceptions, leases, installment sales, or penalties in lieu of arbitrage rebate.

- Sign the form at the bottom, declaring under penalties of perjury that the information provided is accurate and complete. Include the date and the authorized representative's name and title.

- Once the form is filled out, save your changes, download, print, or share as needed to complete your submission.

Complete the Form 8038-GC online today to ensure compliance with IRS reporting requirements for small tax-exempt governmental bonds.

Form 8992 is filed by domestic corporations that hold interests in controlled foreign corporations. This form is utilized to report global intangible low-taxed income (GILTI) and needs to be filed along with corporate tax returns. While it may not directly relate to Form 8038-GC (Rev. November 2000), understanding the distinct tax forms can help organizations ensure comprehensive compliance with tax requirements.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.