Loading

Get Ated Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ated Form online

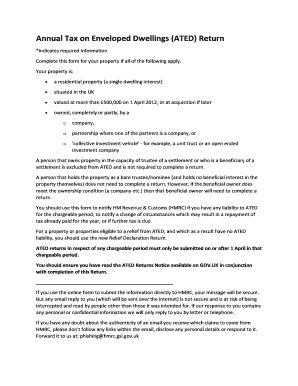

The Annual Tax on Enveloped Dwellings (ATED) return is a crucial document for reporting property liabilities in the UK. This guide will walk you through the necessary steps to complete the Ated Form online accurately and efficiently.

Follow the steps to fill out the Ated Form online.

- Click the ‘Get Form’ button to access the Ated Form. Opening the form in your browser will allow you to begin the process of filling it out online.

- Provide the chargeable person details. This includes entering the name and correspondence address of the chargeable person who owns the property, ensuring to include the UK postcode or country when applicable.

- Enter the ATED Unique Taxpayer Reference Number, which is necessary for identifying the chargeable person in relation to ATED liabilities.

- Enter the contact telephone number and an email address where you prefer to receive confirmations regarding your submission.

- Indicate if this is the first time you are required to make an ATED payment. If so, check the appropriate box.

- Complete the period start and end dates for this return, ensuring the correct format (dd/mm/yyyy) is used.

- Provide the ATED liability amount that relates to your property and enter the relevant relief code if applicable.

- Fill in the property details section, including the property's address and date of acquisition.

- If relevant, indicate whether there has been a professional valuation or if a Pre-Return Banding Check has been requested, entering reference numbers as necessary.

- If applicable, complete the bank details section to facilitate any repayment returns, including account details or IBAN for non-UK accounts.

- Review the declaration section, confirming the accuracy of the information provided, and enter the name and date of the chargeable person.

- If submitting on behalf of a client, fill in the agent details and confirm the client's approval of the return.

- After reviewing all filled sections for accuracy, save the changes. You can then download or print the form for your records or share it as necessary.

Don't delay—complete your Ated Form online today to ensure compliance with tax regulations.

This authority allows HMRC to exchange and disclose information about you with your agent and to deal with them on matters relating to the Annual Tax on Enveloped Dwellings (ATED) and ATED related Capital Gains Tax (CGT) only.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.