Loading

Get Irs Form 6212

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 6212 online

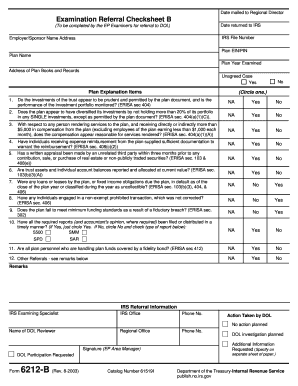

Filling out the Irs Form 6212 online is an essential process for individuals involved in employee benefit plans. This guide will provide clear, step-by-step instructions to help you navigate this form effectively.

Follow the steps to complete Irs Form 6212 online.

- Click the ‘Get Form’ button to access the Irs Form 6212 and open it in your chosen interface.

- Begin by entering the 'Date mailed to Regional Director' field, ensuring that the date reflects when the form is being submitted.

- Complete the ‘Date returned to IRS’ section with the relevant information, if applicable.

- Fill in the 'IRS File Number,' ensuring all letters and numbers are accurate to avoid processing delays.

- Enter the 'Employer/Sponsor Name' along with the corresponding 'Address' in the designated fields.

- Provide the 'Plan EIN/PIN,' followed by the 'Plan Name' and 'Plan Year Examined' to fully identify the plan.

- Next, fill in the 'Address of Plan Books and Records' to detail where the plan's documentation is maintained.

- Indicate whether the case is unagreed by circling 'Yes' or 'No' based on the circumstances.

- For each item on the checklist, circle the appropriate response (NA, Yes, or No) based on your review of the plan's compliance.

- Review the 'IRS Referral Information' section and input the necessary details including the 'IRS Examining Specialist' and 'Phone No.'

- Fill out the 'Action Taken by DOL' section and ensure that you sign the document as the EP Area Manager.

- Once all sections are complete, review the entire form for accuracy before saving changes, downloading, printing, or sharing the completed form.

Complete your Irs Form 6212 online today to ensure timely and effective submission.

To file directly with the IRS, determine which tax form applies to your situation and gather all necessary documentation. You can file your return electronically through the IRS website or send a paper return to the appropriate address. If you are addressing an issue related to IRS Form 6212, ensure your filing is complete and accurate to avoid complications.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.