Loading

Get Form 2333 V

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2333 V online

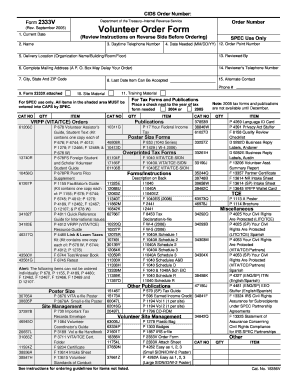

This guide provides a clear and comprehensive overview of how to fill out the Form 2333 V, also known as the Volunteer Order Form, for ordering materials intended for volunteers. By following the steps below, users will be able to complete the online form efficiently.

Follow the steps to complete your Form 2333 V online smoothly.

- Click the ‘Get Form’ button to access the Form 2333 V and open it in your online editor.

- Enter the current date in the designated field to indicate when you are completing the form.

- Provide your name in the appropriate section, ensuring to include any necessary title or designation.

- Fill in your daytime telephone number to facilitate communication regarding the order.

- Specify the delivery location with the complete organization name, building, room, and floor if applicable.

- Complete the mailing address section carefully, as incorrect details may delay the order.

- Indicate the city, state, and ZIP code to ensure accurate delivery of your order.

- Provide the last date by which items must be received; this helps prioritize order urgency.

- If applicable, indicate whether Form 2333X is attached for additional information or requests.

- Select any necessary training and site materials by placing checks next to the relevant items listed.

- Once all fields are filled out, review the form thoroughly for accuracy.

- Finally, save your changes, download a copy of the completed form, and print or share it as needed.

Start filling out your Form 2333 V online today for efficient ordering.

Line 4a on a tax form refers to the total amount of distributions received from IRAs during the tax year. This line is crucial for reporting your income accurately on Form 1040. Understanding this line helps you determine how much income you need to account for, impacting your tax calculations. For further guidance on filling out this part of your tax return, resources like Form 2333 V can be invaluable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.