Get F8854 2006 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F8854 2006 Form online

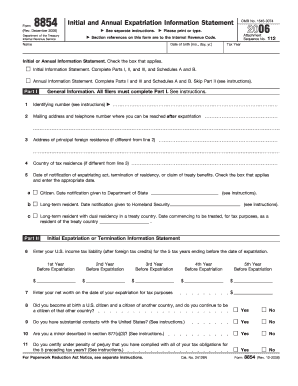

The F8854 2006 Form is necessary for individuals who have expatriated from the United States to report their tax obligations and financial information. This guide provides a clear and user-friendly approach to completing the form online, ensuring you understand each section and requirement.

Follow the steps to complete the F8854 2006 Form online.

- Click the ‘Get Form’ button to access the F8854 2006 Form and open it in the designated editor.

- Begin by filling out Part I, which seeks general information. Enter your identifying number, mailing address, and telephone number where you can be reached after expatriation.

- Provide the address of your principal foreign residence, if different from your mailing address, along with your country of tax residence. Make sure to indicate the date of your expatriating act.

- Complete questions regarding your U.S. income tax liability and net worth for the five tax years before expatriation in Part II. Each year requires specific amounts after foreign tax credits.

- Part III involves annual information reporting under Section 6039G. Carefully list all countries of which you hold citizenship, along with the dates and means by which you became a citizen.

- Proceed to the balance sheet in Schedule A, where you will need to enter the fair market value and adjusted basis of your assets and liabilities as of the date of expatriation.

- Next, fill out Schedule B, which requires you to report your income statement by detailing your sources of income, including U.S. source gross income and gains from the sale of property.

- Review all entered information for accuracy. Once all sections are completed, save your changes, download the form, and proceed to print or share as needed.

Complete your F8854 2006 Form online today to ensure compliance with expatriation reporting requirements.

The F8854 2006 Form is essential for expatriates who want to report their relinquishment of US citizenship or long-term residency. This form helps the IRS assess if you owe an exit tax based on your assets. Proper completion of the F8854 2006 Form is critical for ensuring compliance with US tax obligations. To ease this process, you can utilize platforms like uslegalforms, which help guide you through the necessary documentation.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.