Loading

Get Form 8397

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8397 online

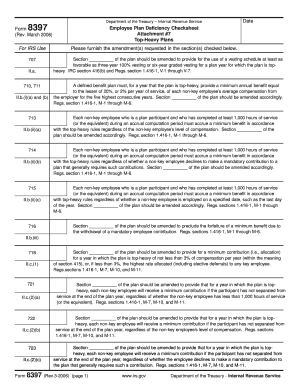

Filling out the Form 8397 is an essential step for employers to ensure compliance with IRS regulations regarding top-heavy plans. This guide provides a step-by-step approach to help users complete this form online effectively.

Follow the steps to accurately fill out the Form 8397 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the sections of the plan that require amendment based on the top-heavy regulations. Carefully read each section, such as vesting schedules and minimum benefits, before filling in the corresponding fields.

- For each section that needs amending, input the necessary details in the designated fields of the form. Ensure that the information corresponds with the appropriate IRC sections and regulations mentioned.

- Review your entries for accuracy, confirming that all relevant sections are addressed in alignment with the top-heavy plan rules.

- Once all information is correctly entered, proceed to save your changes. You can also download, print, or share the completed form as needed.

Complete your Form 8397 online today to ensure compliance with IRS regulations.

Filling out form 8995 instructions involves gathering your income details and understanding the criteria for qualified business income. You’ll need to carefully follow the guidelines for eligible deductions and calculate your QBI. For clarity in tax calculations, referring to Form 8397 can provide additional insights into your withholding and tax obligations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.