Loading

Get 8283 Rev 2006 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 8283 Rev 2006 Form online

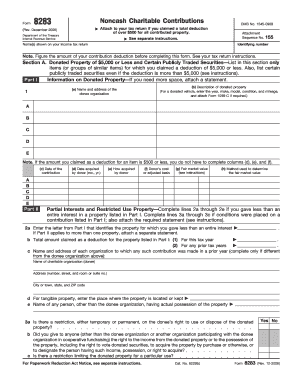

The 8283 Rev 2006 form is used to report noncash charitable contributions when the total deduction exceeds $500. This guide will provide a clear and comprehensive approach to completing the form online, ensuring you fulfill all requirements efficiently.

Follow the steps to complete the 8283 Rev 2006 Form online.

- Click the ‘Get Form’ button to access the 8283 Rev 2006 form and open it in your preferred online editing tool.

- In the upper section, enter the name(s) as shown on your income tax return and your identifying number. Ensure this information matches your tax return exactly.

- Proceed to Section A to list donated property valued at $5,000 or less. For each item, fill out the columns including the name and address of the donee, a description of the donated property, the date of contribution, and the fair market value, if applicable.

- If contributing less than an entire interest in a property, complete Part II by answering questions on the property and attached a required statement if necessary.

- For items valued over $5,000, move to Section B. Describe the donated property and indicate its condition. You will also need to enter details regarding the appraised fair market value.

- Complete the Taxpayer Statement by declaring any items in Part I with an appraised value of $500 or less. Make sure to include the identifying letters from Part I.

- If applicable, have the appraiser fill out the Declaration of Appraiser section, confirming their qualifications and the appraised value.

- Finally, complete the Donee Acknowledgment by the charitable organization, confirming the receipt of the donated property and including their information.

- Once you have completed all sections of the form, save your changes. You can then download the form, print it, or share it as needed, ensuring you keep a copy for your records.

Get started on completing your 8283 Rev 2006 Form online today!

The 82 Form is primarily provided by the IRS. You can access it through their official portal or reliable tax preparation services. Additionally, US Legal Forms simplifies access by offering the form along with instructions for proper completion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.