Loading

Get 2006 Form 6251

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2006 Form 6251 online

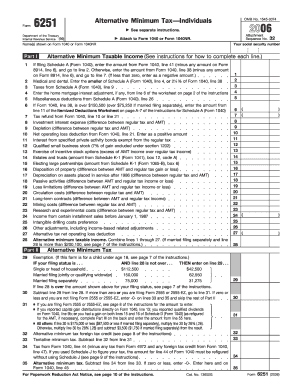

Filling out the 2006 Form 6251 is crucial for individuals subject to the alternative minimum tax. This guide will help you navigate each section of the form with clear instructions to ensure accuracy.

Follow the steps to fill out the form online effectively.

- Press the ‘Get Form’ button to access the form and open it in the document editor.

- Begin by entering your name(s) as shown on Form 1040 or Form 1040NR at the top of the document.

- Complete Part I by calculating your alternative minimum taxable income. Follow the instructions for each line carefully, entering amounts as required.

- In line 28, determine your total alternative minimum taxable income by summing lines 1 through 27.

- Determine the alternative minimum tax exemption based on your filing status and enter this on line 29, referencing the provided exemption amounts.

- Subtract line 29 from line 28. If the result is greater than zero, proceed to line 31; if not, enter zero on lines 33 and 35.

- Compute the alternative minimum tax for individuals in Part II, following the specific lines for tax calculations, adjusting for any additional credits.

- Complete Part III, if applicable, which focuses on tax computation using maximum capital gains rates, following the detailed instructions there.

- Review all the information for accuracy before finalizing your entries. Ensure all calculations are correct.

- Once completed, you can save your changes, download the form for your records, print, or share it as needed.

Start filling out your 2006 Form 6251 online today for accurate tax reporting.

Yes, you can opt not to claim the foreign tax credit on your tax return. However, realize that this choice can impact your overall tax liability significantly, especially if you earn income from abroad. If you decide to fill out the 2006 Form 6251, understanding the implications of your tax credit decisions is vital. Consulting with uslegalforms may provide useful insights to help you make informed tax decisions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.