Get Fill In 4768

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Fill In 4768 online

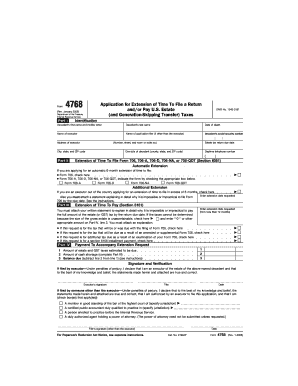

The Fill In 4768 form is used to apply for an extension of time to file U.S. estate and generation-skipping transfer taxes. This guide will provide clear and detailed instructions on how to complete each section of the form online, ensuring users can navigate the process confidently.

Follow the steps to effectively complete your Fill In 4768 form.

- Press the ‘Get Form’ button to obtain the Fill In 4768 form and open it in your preferred online editor.

- Begin with Part I: Identification. Input the decedent's first name, middle initial, and last name, followed by their date of death. Next, provide the name of the executor and the name of the application filer if different from the executor. Include the decedent’s social security number, the executor's address, city, state, and ZIP code, along with the estate tax return due date and the domicile of the decedent.

- In Part II, specify whether you are applying for an automatic extension of six months. Check the appropriate box for the relevant form (706, 706-A, 706-D, 706-NA, or 706-QDT). If you require an additional extension as an executor out of the country, check the appropriate box and attach a detailed statement explaining your situation.

- Proceed to Part III to request an extension of time to pay. Attach a written statement explaining why it is impractical to pay the full amount by the due date. If the tax cannot be determined, check the appropriate box and enter ‘-0-’ or the relevant amount on Part IV, line 3.

- In Part IV, enter the extension date requested, ensuring it does not exceed 12 months. Specify which type of tax the extension is for by checking the applicable boxes.

- Complete the payment details by stating the amount of estate and GST taxes estimated to be due, the amount of cash shortage, and the balance due, which is the result of subtracting the shortage from the estimated taxes.

- Lastly, sign and date the form. If you are the executor, declare that your statements are true and correct. If someone else is filing, they must indicate their relationship to the executor and sign accordingly.

- Review all sections for clarity and completeness, then proceed to save the changes, download, print, or share your Fill In 4768 application.

Complete your Fill In 4768 form online today for an efficient filing process!

To electronically file a tax extension, start by filling in 4768 through a reliable online service. After completing the form, ensure all information is accurate before submitting it. US Legal Forms offers an intuitive interface that guides you through the process seamlessly. Once filed, you should receive confirmation from the IRS, giving you peace of mind that your extension is in place.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.