Get Form Feola19

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form Feola19 online

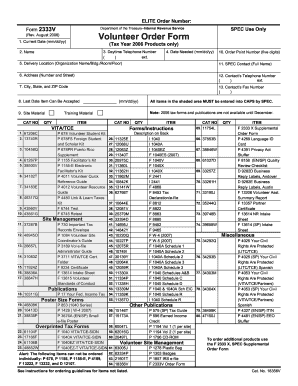

Filling out the Form Feola19 online can be a straightforward process with the right guidance. This form is designed to facilitate the ordering of necessary materials for training and site assistance within the VITA/TCE programs. Follow the steps below for comprehensive assistance in completing the form accurately.

Follow the steps to complete the Form Feola19 online effectively.

- Click the ‘Get Form’ button to access the online version of the Form Feola19, enabling you to edit and fill it out as needed.

- Indicate the current date in the specified format (mm/dd/yy) in the first field of the form.

- Enter your full name in the designated field labeled 'Name'.

- Provide your daytime telephone number, including the extension number if applicable, in the appropriate section.

- Specify the date by which you need the materials, again using the mm/dd/yy format.

- Fill in the order point number as a five-digit code in the corresponding field.

- State the delivery location, ensuring to include the organization name, building, room, and floor if necessary.

- Enter the complete address, including the street number and name.

- Indicate your city, state, and ZIP code in the assigned fields.

- Provide the last date items can be accepted, maintaining the mm/dd/yy format.

- List the item quantities and catalog numbers from the provided options, ensuring to enter items in uppercase letters as indicated.

- At the end of the form, confirm your entries, then save the changes, and choose to download, print, or share the filled form according to your needs.

Ensure you complete your documents online today to streamline your ordering process.

Form 2550Q is used by the IRS to report information related to qualified transportation fringe benefits. This form is relevant for businesses offering commuter benefits to employees. It helps ensure that these benefits are reported and classified correctly for tax purposes. Understanding forms like 2550Q alongside the W-8BEN can provide comprehensive insights into tax compliance.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.