Loading

Get 2007 Form 8404

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 Form 8404 online

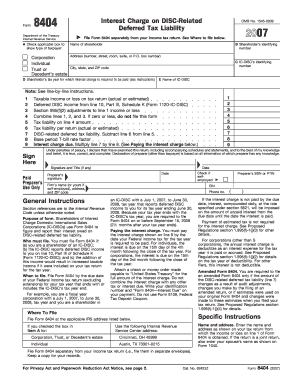

Filling out the 2007 Form 8404 online is a straightforward process that allows shareholders of Interest Charge Domestic International Sales Corporations (IC-DISCs) to report their interest owed on deferred tax liability. This guide will walk you through each section of the form clearly and comprehensively.

Follow the steps to complete the form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by selecting the applicable box in Item A to indicate your taxpayer status: Corporation, Individual, Trust, or Decedent’s Estate.

- In Item B, enter the shareholder’s identifying number. If you are an individual, input your social security number; otherwise, provide your employer identification number.

- For Item C, input the IC-DISC’s identifying number, which can be found on the Schedule K (Form 1120-IC-DISC). If applicable, include numbers from multiple IC-DISCs.

- In Item D, provide the tax year of the shareholder for which the interest charge is to be calculated.

- In Item E, enter the name of the IC-DISC related to the form.

- Complete lines 1 to 9 of the form as follows: - Line 1: Enter your taxable income or loss from your federal income tax return. - Line 2: Input the deferred DISC income from line 10, Part III of Schedule K. - Line 3: Enter Section 995(f)(2) adjustments to line 1 income or loss. - Line 4: Combine the amounts for lines 1, 2, and 3; if zero or less, do not file the form. - Line 5: Record the tax liability based on line 4. - Line 6: Report tax liability according to your return. - Line 7: Calculate the DISC-related deferred tax liability by subtracting line 6 from line 5. - Line 8: Input the base period T-bill rate factor. - Line 9: Calculate the interest charge due by multiplying line 7 by line 8.

- Finally, ensure to sign in the designated areas, date the form, and if applicable, provide details for the paid preparer.

- Once all sections are filled out, you can save changes to the form, download it for your records, print it for submission, or share it as required.

Complete your documents online with confidence and accuracy today.

You can access Form 10IEA online through the IRS or trusted platforms like USLegalForms. Once there, locate the form you need and follow the instructions to download or fill it out digitally. Keeping updated with all necessary forms, including the 2007 Form 8404, is essential for maintaining compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.