Loading

Get Adjustments And Preferences

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Adjustments And Preferences online

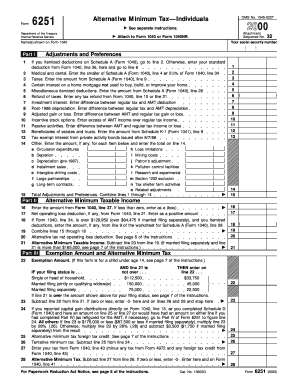

Completing the Adjustments And Preferences form online can streamline your tax preparation and ensure you account for all necessary adjustments. This guide provides a clear, step-by-step approach to help you navigate each section of the form with confidence.

Follow the steps to successfully complete your form.

- Click ‘Get Form’ button to access the Adjustments And Preferences form and open it in your preferred online editor.

- Begin by entering your name as shown on Form 1040 in the designated field at the top of the form. This ensures proper identification for your tax records.

- In Part I, start with line 1 and determine whether you itemized deductions on Schedule A. If so, proceed to line 2; if not, enter your standard deduction from Form 1040, line 36, and move to line 6.

- Continue to fill in the specified amounts for medical and dental expenses (line 2), taxes (line 3), and any other adjustments outlined in the form, ensuring accuracy in each entry.

- Once you have completed lines 1 through 14, total your adjustments and preferences in the provided space at the bottom of Part I.

- Proceed to Part II, entering the amount from Form 1040, line 37. If it's less than zero, indicate it as a loss. Follow through lines 15 to 20, combining the necessary values as instructed.

- In Part III, complete lines related to Exemption Amount and Alternative Minimum Tax by carefully following the guidelines provided for your filing status.

- After filling out all necessary sections, review the form for any potential errors or omissions before finalizing.

- Once satisfied with your entries, save your changes. You can then download, print, or share the completed form based on your needs.

Complete your Adjustments And Preferences form online today and ensure your tax filing is accurate and efficient.

AMT adjustment or preference items can be split into deferral (temporary items) and exclusion (permanent) items. Exclusion items: Exclusion items are adjustment or preference items that affect only one tax year and cause a permanent difference between regular taxable income and AMTI.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.