Loading

Get 2007 Irs Form 3903

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2007 IRS Form 3903 online

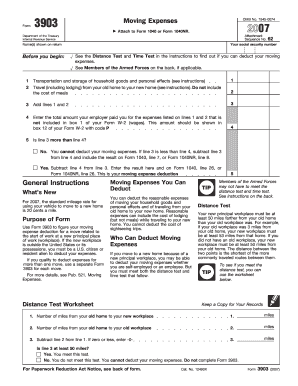

Filling out IRS Form 3903 online allows you to claim moving expenses that may be deductible if you meet specific criteria. This guide provides a detailed overview of each section and the steps necessary to complete the form accurately.

Follow the steps to successfully complete the form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- In the top section, provide the name(s) shown on your tax return and your Social Security number. This ensures proper identification.

- For line 1, enter the total amount of expenses related to transporting and storing household goods and personal effects. Refer to the relevant guidelines for what can be included.

- For line 2, record the amount spent on travel from your old home to your new home, including lodging costs but excluding meals.

- Add the amounts from lines 1 and 2 to get the total moving expenses and enter this total on line 3.

- On line 4, list any reimbursements from your employer for these moving expenses that are not included on Form W-2.

- Evaluate if the total on line 3 exceeds that on line 4. If it does, calculate the difference and enter it on line 5 to determine your moving expense deduction. If not, you cannot deduct moving expenses.

- Once all fields are completed and double-checked for accuracy, you can save your changes, download a copy of the form, print it out, or share it as needed.

Complete the 2007 IRS Form 3903 online today to ensure you can claim your eligible moving expenses.

To file an income tax declaration, gather your documents, including the 2007 IRS Form 3903 if applicable. You can file electronically or by mail, depending on your preference. A platform like UsLegalForms can assist you in preparing and submitting your tax forms accurately.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.