Loading

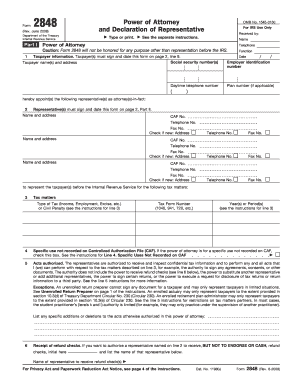

Get Form 2848 June 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 2848 June 2008 online

This guide provides users with detailed instructions on how to fill out the Form 2848 June 2008 online. Following these steps ensures proper submission for representation before the Internal Revenue Service.

Follow the steps to fill out Form 2848 effectively.

- Click ‘Get Form’ button to access the Form 2848 online and open it in your chosen editor.

- In Part I, enter the taxpayer information. Provide the taxpayer's name, social security number, and address. Ensure that the taxpayer(s) sign and date this form on page 2, line 9.

- List the representative(s) you are appointing as attorney(s)-in-fact in the designated area. Include their names, addresses, telephone numbers, and any applicable Fax numbers.

- Specify the tax matters for which the representative(s) will be authorized. This includes selecting the type of tax and providing the relevant tax form numbers and years or periods.

- If the power of attorney is for specific uses not already recorded, check the appropriate box. Otherwise, proceed to authorize acts that representatives can carry out. Note the exceptions and limitations as detailed in line 5.

- Initial the box and list the representative's name if you authorize them to receive refund checks without endorsing or cashing them.

- Indicate how notices and communications should be handled. If needed, choose whether to send copies to additional representatives.

- Decide whether to revoke prior powers of attorney. If you wish to keep a prior power in effect, attach the necessary documentation.

- Both the taxpayer(s) must sign and date the form on the designated line to make it valid. If applicable, ensure that corporate officers or other representatives also sign accordingly.

- In Part II, representatives must complete their declaration by signing and dating this section. They must also specify their designation and jurisdiction.

- After completing the form, save changes, download, print, or share the Form 2848 as needed.

Start filling out your Form 2848 online today for timely representation.

Common errors on Form 2848 June 2008 include providing incorrect taxpayer identification numbers and incomplete representative details. Failing to sign the form or misplacing the mailing address often leads to delays in processing. Be diligent in reviewing your information before sending the form to avoid these common pitfalls.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.