Get Form 709

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 709 online

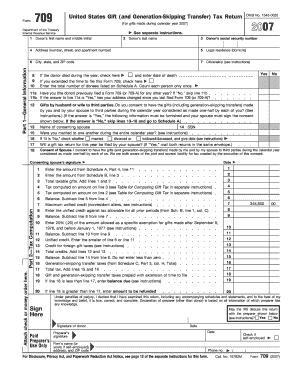

Form 709 is the United States gift (and generation-skipping transfer) tax return that must be filed by donors to report gifts to individuals and entities. This guide will provide a step-by-step approach to successfully complete and submit Form 709 online, ensuring that users understand each component clearly.

Follow the steps to complete the Form 709 online:

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Part 1—General Information. Enter the donor's first name and middle initial, last name, social security number, and address (number, street, and apartment number). Make sure to provide the legal residence, which includes the city, state, and ZIP code.

- Indicate citizenship status and check whether the donor passed away during the year. If applicable, note the date of death.

- Complete lines regarding previous filings. If the donor has filed Form 709 previously, confirm if the address has changed.

- Answer the questions about gift splitting between spouses. If applicable, provide the name of the consenting spouse and confirm marital status for the entire year.

- Proceed to Part 2—Tax Computation. Fill in the amounts from Schedule A and Schedule B. Add the total taxable gifts to compute the tax based on the guidelines provided.

- Make sure to complete all sections including potential deductions and credits available for the gifts reported. Calculate the total amount due or refund anticipated.

- Finally, sign and date the form, ensuring to include the preparer's information if applicable. Review all details to confirm accuracy before completing the submission.

- Save the changes, and then choose to download, print, or share the completed Form 709 as needed.

Start completing your Form 709 online today for an efficient and straightforward filing experience.

Filling out IRS Form 709 can be challenging due to its detailed requirements and the information needed. However, many people find it manageable with the right tools and resources, such as the US Legal Forms platform, which offers helpful templates and instructions. Consider taking your time to understand each section, and don't hesitate to seek professional assistance if needed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.