Loading

Get Irs Form 1118

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 1118 online

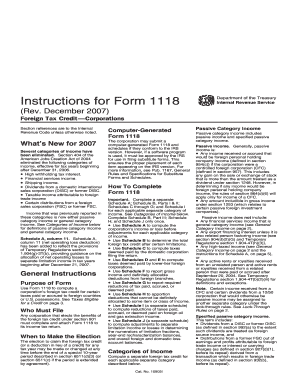

Filling out the Irs Form 1118 online can be a straightforward process with the right guidance. This form is essential for corporations looking to claim a foreign tax credit, and understanding each section will ensure compliance and accuracy in your tax filings.

Follow the steps to successfully complete the Irs Form 1118 online.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin with the purpose of Form 1118, which is to compute the corporation’s foreign tax credit for taxes paid or accrued to foreign countries. Ensure you complete a separate Schedule A for each category of income.

- Fill out Schedule A by reporting gross income or loss from sources outside the United States. Use the appropriate columns to input different types of income, such as dividends, interest, and other gross income.

- Using Schedule B, report any foreign taxes paid or accrued. Make sure to provide accurate financial data as it’s critical for calculating your foreign tax credit.

- Complete additional Schedules C through J as needed, ensuring that each applicable category of income has separate columns filled out accurately.

- Check that all totals are correctly calculated across the schedules and that any necessary documentation is available for support.

- Once all sections are filled, review your entries for correctness. Save your changes and proceed to download, print, or share the form as needed.

Start your online filing process for the Irs Form 1118 to ensure accurate and timely submission.

To file for the foreign earned income exclusion, you will submit IRS Form 2555 along with your tax return. Ensure to report your foreign earnings correctly and meet the physical presence or bona fide residence tests. The Irs Form 1118 may come into play if you have foreign taxes that need to be credited against your U.S. tax liability.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.