Loading

Get F4868 Download Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the F4868 download form online

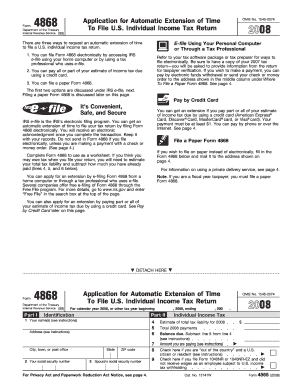

Filling out the F4868 download form online allows individuals to request an automatic extension of time to file their U.S. individual income tax returns. This step-by-step guide provides clear instructions to ensure you complete the form accurately and effectively.

Follow the steps to fill out the F4868 download form online.

- Click the ‘Get Form’ button to obtain the form and open it for editing.

- In Part I, enter your name(s) as they will appear on your tax return, along with your address, social security number, and your spouse's social security number if applicable.

- In Part II, Line 4 requires you to estimate your total tax liability for the year. Ensure this estimate is as accurate as possible.

- On Line 5, enter the total of any payments you expect to report for the year. Be mindful to exclude the amount you are paying with this form.

- Calculate the balance due by subtracting Line 5 from Line 4 on Line 6. If Line 5 exceeds Line 4, enter '0'.

- In Line 7, indicate the amount you are paying with this form. Payments can be made through various methods, including electronic funds withdrawal, credit card, or check.

- If you are out of the country on the regular due date, check the box on Line 8.

- If you are filing Form 1040NR or 1040NR-EZ without receiving wages as an employee, check the box on Line 9.

- Review all entries for accuracy. Once confirmed, save your changes, download a copy for your records, and print or share it as needed.

Complete your documents online today to ensure timely filing!

You can download your tax statement by visiting the IRS website or services such as US Legal Forms. Simply search for the relevant form, including the F4868 Download Form, and click to download. This process allows you to manage your tax documents conveniently.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.