Loading

Get Form 4669

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4669 online

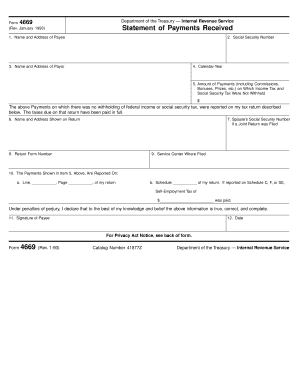

Form 4669 is a statement of payments received, essential for reporting payments without federal income or social security tax withholding. This guide provides a clear, step-by-step approach to helping users fill out the form accurately online.

Follow the steps to complete the Form 4669 online.

- Press the ‘Get Form’ button to retrieve the form and open it in your preferred online editor.

- Provide your name and address in the designated fields at the top of the form. Ensure the information is accurate and matches your records.

- Enter your social security number in the specified space. This number is essential for identifying your records.

- Fill in the name and address of the payor (the entity that made the payments to you). Make sure this information is correctly represented.

- Indicate the calendar year during which the payments were made. This helps in the accurate reporting of tax information.

- Input the total amount of payments received in the specified section. Include all relevant payments such as commissions, bonuses, or prizes.

- Complete the sections detailing where the reported payments are reflected on your tax return. Indicate the line number and page on your return.

- If applicable, include your spouse’s social security number if you filed a joint return. This ensures that all necessary information is accounted for.

- Provide the return form number you used for your tax filing. This is crucial for linking your payments with the correct return.

- Sign and date the form to certify that the information provided is true and complete. This declaration is legally binding under penalties of perjury.

- Finally, save your changes, and choose your preferred method to download, print, or share the form as needed.

Begin filling out your Form 4669 online today for a smooth and efficient tax reporting experience.

Yes, you can download your 1099 form online if your payer offers electronic access. Typically, employers and financial institutions provide secure portals where you can easily access and download these forms. If you're managing multiple tax documents like Form 4669 or others, downloading them electronically can save you time and effort.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.