Loading

Get 2009 Form 982

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 982 online

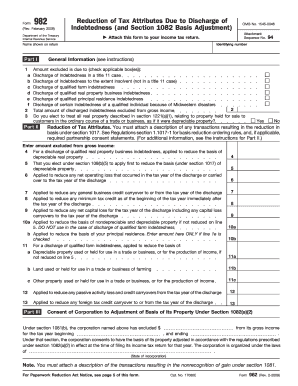

This guide provides a clear, step-by-step overview for users on how to fill out the 2009 Form 982 online. Following these instructions will help ensure compliance with tax regulations regarding the exclusion of discharged indebtedness from gross income.

Follow the steps to complete the 2009 Form 982 online effectively.

- Press the ‘Get Form’ button to begin the process and access the form in your preferred editor.

- In Part I, enter your name as shown on your income tax return in the designated field. Provide your identifying number and check applicable boxes to indicate the reason for the discharge of indebtedness.

- For line 2, enter the total amount of discharged indebtedness that you are excluding from your gross income.

- Choose whether to treat all real property as depreciable by checking 'Yes' or 'No' in line 3.

- If applying for a reduction of tax attributes in Part II, follow the instructions provided based on the specific circumstances of your discharge. Enter amounts in the corresponding lines (4-13) as applicable.

- In Part III, if applicable, provide the necessary consent information regarding the adjustment of basis of property under Section 1082(a)(2).

- After filling out all relevant sections, review the form for accuracy. Save your changes, then download, print, or share the completed form as needed.

Complete your tax documents online to ensure a smooth filing process.

Taxpayers who have experienced debt cancellation and wish to exclude that amount from their taxable income must file the 2009 Form 982. If your debts were forgiven and you were insolvent at the time, submitting this form is crucial. Additionally, individuals with specific losses related to business or investment may also need to use this form. Understanding your filing obligations is essential to avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.