Loading

Get 2009 Form 4952

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

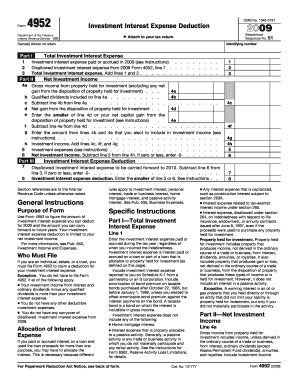

How to fill out the 2009 Form 4952 online

Filling out the 2009 Form 4952 online allows you to calculate your investment interest expense deduction efficiently. This guide provides detailed, step-by-step instructions to ensure you accurately complete the form and maximize your deductions.

Follow the steps to fill out Form 4952 online.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Begin with Part I of the form. Here, you will enter the total investment interest expense you paid or accrued during 2009 on line 1. Include any amounts reported to you on Schedule K-1.

- On line 2, enter any disallowed investment interest expense from your 2008 Form 4952. Then, add the amounts from lines 1 and 2, entering the total on line 3.

- Proceed to Part II where you will calculate your net investment income. Start by entering your gross income from property held for investment on line 4a. Remember to exclude any net gain from property dispositions.

- On line 4b, input the amount of qualified dividends included in the total from line 4a. Next, subtract this amount from line 4a and enter the result on line 4c.

- If you have any net gain from the disposition of property held for investment, include it on line 4d, then calculate the net capital gain to be entered on line 4e.

- Line 4g allows you to elect to include part of your qualified dividends and net capital gains in your investment income. Enter the amount here.

- Add lines 4c, 4f, and 4g to determine your investment income, which should be entered on line 4h. On line 5, list any investment expenses directly related to producing that income.

- Calculate your net investment income by subtracting line 5 from line 4h; if the result is zero or less, enter -0- on line 6.

- In Part III, subtract line 6 from line 3 on line 7 to determine the disallowed investment interest expense to be carried forward to 2010 and enter this on line 8.

- Finally, enter the smaller of the amounts on line 3 or line 6 as your investment interest expense deduction on line 8. Review all entries for accuracy before finalizing.

- Once completed, save any changes made to the form, and proceed to download, print, or share the document as necessary.

Start filling out your documents online for a seamless experience.

Related links form

Yes, you need to declare your investments on your tax return as they can generate taxable income. Whether it’s through capital gains or dividends, your investment activities must be reported. Form 4952, specifically the 2009 version, can assist with calculating any deductible investment interest. Using the uslegalforms platform simplifies this process, guiding you in the right direction.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.