Loading

Get 2009 2106 Ez Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 2106 EZ Form online

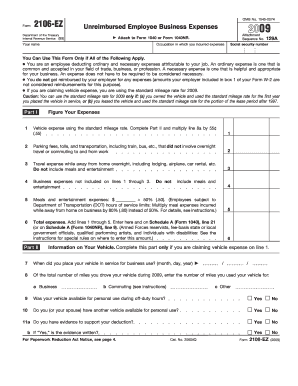

Filling out the 2009 2106 EZ Form can be straightforward with the right guidance. This form is used to claim unreimbursed employee business expenses and understanding its components is essential for successful completion.

Follow the steps to complete the form efficiently.

- Press the ‘Get Form’ button to access the form and open it within your document editor.

- Begin by entering your name and occupation where expenses were incurred. You will also need to provide your social security number.

- In Part I, calculate your expenses. For vehicle expenses, complete Part II and multiply the mileage by the 2009 rate of 55 cents.

- On line 1, input parking fees, tolls, and transportation costs that did not involve overnight travel or commuting.

- On line 2, report travel expenses for overnight stays, excluding meals and entertainment.

- For line 3, include other business-related expenses such as business gifts or subscriptions that are not listed elsewhere.

- On line 4, detail your meals and entertainment expenses, applying the appropriate percentage deduction.

- Total your expenses on line 5 by adding lines 1 through 4 and carry this amount to the appropriate schedule.

- In Part II, if claiming vehicle expenses, provide the date when the vehicle was first put into business use and detail the business mileage.

- Complete the remaining fields regarding vehicle usage, including evidence of deductions and personal use availability.

- Finally, review your entries for accuracy and completeness. You may then save changes, download, print, or share the completed form as needed.

Complete your documents online today to ensure efficient submission.

For mileage reimbursement, it's essential to provide proof such as a mileage log, receipts for any related expenses, and documentation of the trip's purpose. By using the 2009 2106 Ez Form, you can systematically present your miles traveled and substantiate your claims. Good record-keeping is vital for a smooth reimbursement process.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.