Loading

Get 2009 Form 945

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2009 Form 945 online

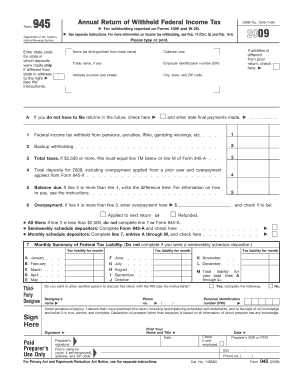

Filing the 2009 Form 945, the annual return of withheld federal income tax, online is a straightforward process. This guide provides you with step-by-step instructions to ensure accurate completion of the form.

Follow the steps to fill out the 2009 Form 945 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your details in the 'Name' section. This should reflect your legal name distinct from any trade name you may use.

- Fill in the 'Employer identification number (EIN)' in the specified box. If you do not have an EIN, indicate 'Applied For' and the date you applied.

- Provide your complete address, including the street address, city, state, and ZIP code. Make sure this matches your records.

- Indicate the calendar year; ensure it reflects 2009.

- Complete the income tax withheld section, reporting the total withheld from pensions, annuities, and other sources.

- Fill in the backup withholding if applicable, followed by calculating the total taxes up to line 3.

- Record the total deposits in line 4, including overpayments from previous years.

- Determine if there is a balance due in line 5 or an overpayment in line 6, and provide the necessary calculations.

- Complete lines regarding monthly summaries if applicable. Only monthly schedule depositors should complete this section.

- Indicate if you wish to designate a third party to discuss this return with the IRS by filling out the designee's name and contact details.

- Finally, review the form for accuracy, provide your signature, and date the form. If applicable, include your preparer's information.

- After completing the form, save your changes, download a copy for your records, print, or share the form as necessary.

Complete your 2009 Form 945 online with confidence. Start filling out your form today.

The 2009 Form 945 captures information on non-payroll payments and the corresponding federal income tax withheld. This includes details about the total payments and the amount withheld for federal taxes. Proper completion of this form ensures that all necessary details are communicated to the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.