Loading

Get Ss10 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Ss10 Form online

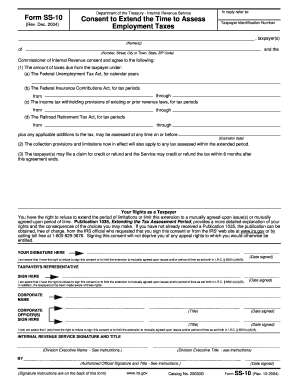

The Ss10 Form is an important document used to consent to the extension of the time to assess employment taxes. This guide provides clear, step-by-step instructions to help you fill out this form accurately and efficiently online.

Follow the steps to complete the Ss10 Form online effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering the taxpayer identification number in the designated field.

- Next, provide the name(s) of the taxpayer(s) required in the form.

- Fill in the address of the taxpayer, including the number, street, city or town, state, and ZIP code.

- In the section regarding tax due, specify the amount due under the Federal Unemployment Tax Act and detail the calendar years as required.

- Proceed to declare any amounts due under the Federal Insurance Contributions Act, clarifying the tax periods.

- In the subsequent fields, complete information related to the income tax withholding provisions, specifying the applicable tax periods.

- If relevant, provide details concerning the Railroad Retirement Tax Act and its associated tax periods.

- State the expiration date for the assessment in the field provided.

- Read the section on your rights as a taxpayer carefully, ensuring you understand your options. This is vital before signing the consent.

- Sign the consent in the designated area, confirming your awareness of your rights.

- If applicable, have the taxpayer's representative sign the form, along with their date of signature.

- If the taxpayer is part of a corporation, ensure the corporate name and the authorized officer(s)' signatures are completed.

- Finally, review all completed sections for accuracy, then save your changes, and choose to download, print, or share the form as needed.

Take action now and complete your documentation online.

To claim your pension benefits, you need to use the appropriate form, which may include the Ss10 Form for specific cases. This form helps you provide the necessary information related to your pension plan. By completing the Ss10 Form accurately, you can ensure a smooth processing of your pension claims. It's essential to review the prerequisites for your pension to ensure you submit the correct documentation.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.