Loading

Get Form 12256

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12256 online

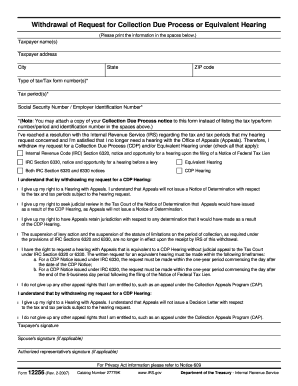

Filling out Form 12256 online is a straightforward procedure that allows you to withdraw your request for a Collection Due Process or Equivalent Hearing. This guide provides clear, step-by-step instructions to ensure you successfully complete the form with confidence.

Follow the steps to complete Form 12256 online.

- Click ‘Get Form’ button to obtain the form and open it in the digital editor.

- Begin by entering the taxpayer name(s) in the appropriate field. This should include the name of the person or entity who is withdrawing the hearing request.

- Next, fill in the taxpayer address, ensuring that all parts of the address are complete, including city, state, and ZIP code.

- Specify the type of tax and the corresponding tax form number(s) and tax period(s). If this information is extensive, consider attaching a copy of your Collection Due Process notice instead.

- In the section where you indicate you've reached a resolution with the IRS, you will check all applicable boxes regarding the type of hearing you are withdrawing.

- Review the implications of withdrawing your request, as outlined in the listed rights that you forfeit, such as the right to a hearing and the suspension of levy action.

- Lastly, sign the form. If applicable, include your spouse's signature and the signature of any authorized representative.

- Once all sections are completed, you can save changes, download, print, or share the completed form for submission.

Take action today and complete your documents online.

The W-8BEN form is primarily used for certifying foreign status for tax purposes. It allows non-U.S. persons to claim benefits under U.S. tax treaties, thus potentially lowering the withholding tax rate on certain types of income received from U.S. sources. For complete clarity and support regarding tax forms like 12256 and W-8BEN, exploring resources like USLegalForms can be highly beneficial.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.