Get 2643s - Missouri Special Events Application

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2643S - Missouri Special Events Application online

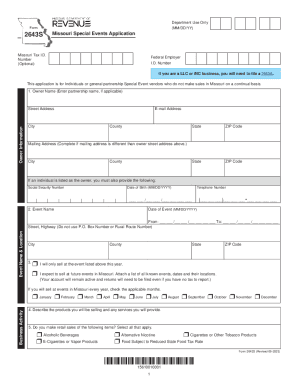

Filling out the 2643S - Missouri Special Events Application online is a straightforward process that helps vendors participate in special events across Missouri. This guide provides an easy-to-follow approach to ensure you complete the application accurately and efficiently.

Follow the steps to effectively complete your application.

- Click the ‘Get Form’ button to access the application form. This will allow you to view and fill out the necessary fields conveniently in an online format.

- Enter the owner information at the top of the form. This includes the owner name, street address, email address, city, county, state, ZIP code, and, if applicable, a different mailing address.

- Provide the Social Security number and date of birth of the owner if the business is a sole proprietorship. If a partnership is applicable, include the partnership name instead.

- Fill out the event details, including the event name, the telephone number for contact, and the event date. Specify the location by providing the street address, city, county, state, and ZIP code.

- Indicate whether you will only sell at the specified event this year or expect to participate in future events in Missouri. If expecting to participate in other events, attach a separate list detailing the events, dates, and locations.

- Check the applicable months during which you plan to conduct sales if you will be participating in future events in Missouri.

- Describe the products and services you plan to sell at the event in the designated field.

- Select all applicable retail items you will sell, such as alcoholic beverages, e-cigarettes, alternative nicotine, and food subject to reduced state food tax rates.

- If applicable, identify all partners responsible for tax matters including their names, Social Security numbers, and other requested details.

- Complete the signature section to confirm that the information provided is true and correct. This must be signed by the owner or an authorized partner listed in the previous sections.

- After reviewing your completed application, save your changes, and then download, print, or share the form as needed.

Complete your 2643S - Missouri Special Events Application online today for a smooth event registration experience.

All sales of tangible personal property and taxable services are generally presumed taxable unless specifically exempted by law. Persons making retail sales collect the sales tax from the purchaser and remit the tax to the Department of Revenue. The state sales tax rate is 4.225%. Sales/Use Tax - Missouri Department of Revenue - MO.gov mo.gov https://dor.mo.gov › taxation › business › tax-types › sal... mo.gov https://dor.mo.gov › taxation › business › tax-types › sal...

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.