Get 2010 Form 8919

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8919 online

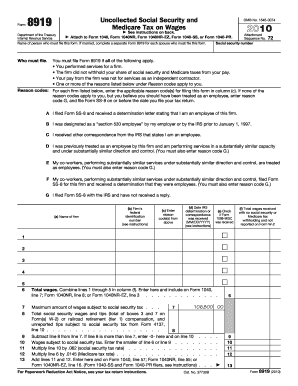

Filling out the 2010 Form 8919 is essential for reporting uncollected social security and Medicare taxes if you were treated as an independent contractor. This guide will provide clear steps to assist you in completing the form accurately online.

Follow the steps to fill out the 2010 Form 8919 online.

- Click the ‘Get Form’ button to obtain the form and open it in your compatible document editor.

- In the first section, enter the name of the person who must file this form. If married, ensure each spouse completes a separate Form 8919.

- Determine if you must file this form by evaluating the criteria provided. If you performed services for a firm that did not withhold your social security and Medicare taxes but are not classified as an independent contractor, you will need to proceed.

- Begin entering details for each firm in lines 1 through 5. Complete a separate line for every firm where you worked in 2010.

- Collect the details about the IRS determination or correspondence received (column d), whether a Form 1099-MISC was received (column e), and total wages received without withholding (column f).

- After entering all necessary information for lines 1-5, combine the total wages from column f and enter this total on line 6.

- Complete lines 7 through 13 as instructed to calculate the total social security and Medicare taxes owed, ensuring to do so on only one Form 8919.

- Review all entries for accuracy and ensure that reason codes and details align with the IRS guidelines.

- Once you have completed the form in its entirety, you may save your changes, download, print, or share the completed Form 8919 as needed.

Be proactive and complete your Form 8919 online today to ensure your social security and Medicare taxes are accounted for accurately.

The 1040 NR form is used by non-resident aliens for reporting U.S. income and taxes. If you are not a U.S. citizen or resident but earn income in the U.S., you may need to file this form. It is important to complete the 2010 Form 8919 appropriately if you are in this situation to account for any misclassified income. Being informed about your tax status ensures compliance with tax regulations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.