Loading

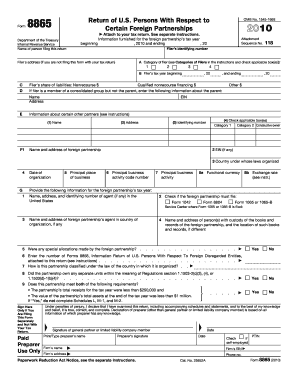

Get 2010 Form 8865

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2010 Form 8865 online

Filling out the 2010 Form 8865 is essential for U.S. persons involved in certain foreign partnerships. This guide provides clear and supportive instructions to help users navigate each section and field of the form with confidence.

Follow the steps to complete the 2010 Form 8865 accurately.

- Click 'Get Form' button to access the form and open it in your browser.

- Enter the name of the person filing the return in the designated field of the form.

- Select the applicable category of filer by checking the corresponding box under section A. Be sure to review the Categories of Filers in the instructions.

- Provide the filer's tax year beginning and ending dates in section B.

- Fill in the filer's identifying number along with the address in section D.

- Input the necessary information for the foreign partnership, including its name, address, and country of organization in section G.

- Address any special allocation queries indicated in the subsequent sections and check yes or no as applicable.

- Complete the income statement, detailing gross receipts, deductions, and any ordinary income or loss in the various fields provided.

- Move on to the capital gains and losses sections by using the appropriate schedules provided in the form.

- Finalize your form by signing in the indicated area as the general partner or limited liability company member. Ensure that you do not miss the preparer’s signature if applicable.

- Once you have completed the form, you can save your changes, download a copy, print it for your records, or share it as needed.

Visit the IRS website to complete your 2010 Form 8865 online today.

To fill out the foreign earned income exclusion, you will need to complete Form 2555 or Form 2555-EZ alongside the 2010 Form 8865. These forms require details about your foreign income and the duration of your stay abroad. Consider consulting resources on uslegalforms, which can guide you in completing these forms accurately. Ensuring you provide precise information helps you maximize your exclusions and deductions.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.