Get Irs 2010 Form 8396

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 2010 Form 8396 online

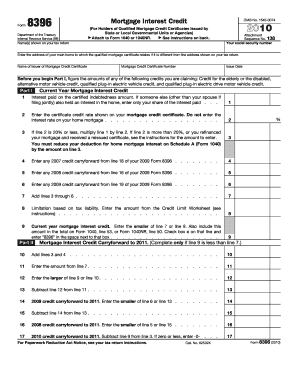

Filling out the IRS 2010 Form 8396 is essential for individuals holding a qualified mortgage credit certificate. This guide will provide you with step-by-step instructions tailored for an online environment, ensuring you can confidently complete the form without any hassle.

Follow the steps to complete your Form 8396 online.

- Click ‘Get Form’ button to access the form and open it in your preferred digital editor.

- In the first section, provide the names shown on your tax return and enter your social security number. If your main home address differs from your tax return, enter that address as well.

- Identify and enter the name of the issuer of your mortgage credit certificate and the corresponding mortgage credit certificate number, along with the issue date.

- Before beginning Part I, summarize any other credits you are claiming like credit for the elderly or the disabled. This will be important for calculating your mortgage interest credit.

- For Line 1 in Part I, enter the interest paid on the certified amount shown on your mortgage credit certificate. If applicable, only enter your share of the interest paid if others shared interest in the home.

- For Line 2, refer to your mortgage credit certificate for the certificate credit rate, which should be between 10% and 50%. Do not confuse this with the interest rate of your home mortgage.

- In Line 3, if your credit rate on Line 2 is 20% or less, multiply Line 1 by Line 2. If it exceeds 20% or if you refinanced, refer to the instructions to determine the correct amount for this line. Remember to adjust your home mortgage interest deduction accordingly.

- If you have any unused credit carryforwards from previous years, complete Lines 4 to 6 with the respective amounts from your prior 2009 Form 8396.

- Add Lines 3 through 6 and record the sum on Line 7. Then, for Line 8, find the limitation based on your tax liability using the credit limit worksheet.

- For Line 9, submit the lesser of Line 7 or Line 8 as your current year mortgage interest credit. Ensure to include this amount on your Form 1040 or Form 1040NR.

- Complete Part II if applicable to carry forward unused credit to 2011, and follow the instructions provided for Lines 10 through 17 accordingly to determine the carryforward amounts.

- Once all fields are completed, review your entries for accuracy, and then save your changes. You may choose to download, print, or share the completed form as needed.

Start filling out your IRS 2010 Form 8396 online today to ensure your mortgage interest credit is claimed correctly.

An example of a mortgage credit certificate (MCC) is a certificate issued by a state or local government that allows qualifying buyers to claim a percentage of their mortgage interest as a tax credit. For instance, if a homeowner has an MCC that allows them to claim 20% of their mortgage interest, they can directly reduce their tax liability by that amount. Utilizing the IRS 2010 Form 8396 accurately is vital for claiming this benefit. For more information and resources, visit uslegalforms.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.