Loading

Get Form 4137 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 4137 2010 online

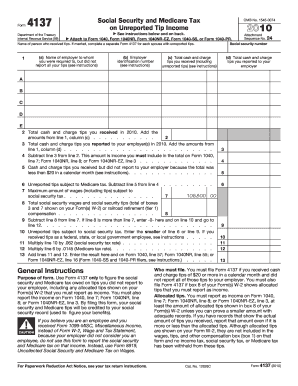

Filling out the Form 4137 2010 is essential for reporting unreported tip income for proper tax purposes. This guide provides clear, step-by-step instructions that will help users navigate each section of the form efficiently.

Follow the steps to complete the form accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering your social security number and the name of the person who received tips in the appropriate fields. If applicable, complete a separate Form 4137 for each partner with unreported tips.

- In line 1, fill out the details for each employer. For each employer, provide their name in column (a), the employer identification number in column (b), and the total cash and charge tips received, including unreported tips, in column (c).

- For line 2, aggregate and enter the total cash and charge tips received from line 1, column (c).

- For line 3, add and enter the total cash and charge tips reported to your employer in 2010 from line 1, column (d).

- On line 4, subtract line 3 from line 2 to determine the income you must include on your primary tax form. This is done by entering the result of this calculation.

- If you received cash and charge tips that were not reported because they totaled less than $20 in a calendar month, enter this information on line 5.

- For line 6, enter the unreported tips that are subject to the Medicare tax by subtracting line 5 from line 4.

- For line 10, identify any unreported tips subject to the social security tax and enter that amount.

- Complete lines 11 through 13 by calculating the social security and Medicare taxes owed based on the specified rates, and ensure the results are recorded on your primary tax form.

- Once all sections are filled out correctly, you can save changes, download, print, or share the form as needed.

Start completing your Form 4137 online to ensure accurate tax reporting.

For reporting tips, you should use Form 4137 2010. This form specifically addresses unreported tip income and helps you calculate the necessary taxes owed on those tips. Remember, providing accurate information on Form 4137 is crucial for proper tax reporting. Using the correct form simplifies the process of managing your finances.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.