Loading

Get Irs Form 990 Schedule L 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 990 Schedule L 2011 online

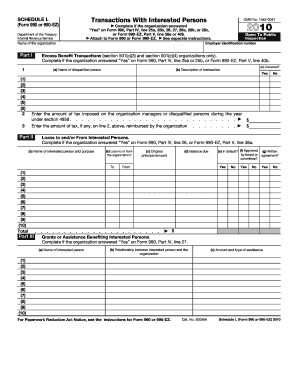

Filling out the IRS Form 990 Schedule L is essential for ensuring compliance with tax regulations for organizations. This guide provides a clear, step-by-step approach to completing the form online, helping users navigate its components easily.

Follow the steps to complete your Form 990 Schedule L efficiently.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Start by filling in the name of the organization in the designated field at the top of the form. Ensure that the name exactly matches the registered name of the organization.

- Enter the employer identification number (EIN) in the corresponding field. This number is crucial for tax identification.

- Proceed to Part I. Check the relevant boxes indicating if your organization has answered 'Yes' on Form 990, Part IV, lines 25a, 25b, 26, 27, 28a, 28b, or 28c.

- Complete the fields related to transactions with disqualified persons, noting the name, description of the transaction, and whether any adjustments are necessary.

- Move to Part II for loans to or from interested persons. Fill in the details, including names and loan amounts, as applicable.

- In Part III, address any excess benefit transactions. Complete the corresponding fields if your organization answered 'Yes' on the applicable Form 990 sections.

- Continue with Part IV, where you will outline any business transactions involving interested persons. Be precise with the amounts and descriptions.

- Finally, complete Part V by providing any supplemental information that clarifies previous responses or offers additional context.

- After reviewing all entries for accuracy, save your changes, and proceed to download, print, or share the completed form as needed.

Start filling out your IRS Form 990 Schedule L online today for a smoother compliance experience.

Related links form

To file IRS Form 990-N for prior years, visit the IRS website and navigate to the e-filing section. You will need to accurately complete the form for each relevant year and submit it electronically. Using services like uslegalforms can streamline the process and ensure that your filing meets all necessary requirements.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.