Loading

Get 2023 Small Business Property Tax Exemption Claim Under ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

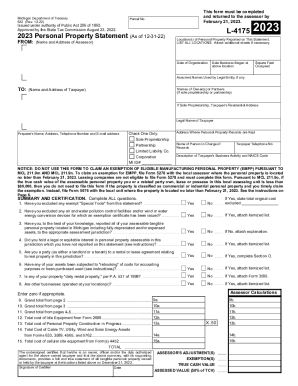

How to fill out the 2023 Small Business Property Tax Exemption Claim online

Completing the 2023 Small Business Property Tax Exemption Claim is crucial for small business owners seeking to claim property tax exemptions. This comprehensive guide provides clear, step-by-step instructions to assist you in accurately filling out the form online.

Follow the steps to successfully complete your exemption claim form.

- Click the 'Get Form' button to obtain the necessary form and access it in your editing environment.

- Begin filling out the form by providing your Parcel Number and details about the assessed personal property at all locations. Make sure to list all relevant locations, and attach additional sheets if necessary.

- Enter your business details in the specified sections, including the date of organization, date business began at that address, square feet occupied, and any assumed names used by your legal entity.

- Complete the section for ownership details by providing the name(s) of owners or partners, and if applicable, the sole proprietor’s residential address.

- Fill in the legal name of the taxpayer, address where personal property records are kept, and the name of the person in charge of those records, along with their contact information.

- Indicate the type of legal organization by checking the appropriate box (sole proprietorship, partnership, limited liability company, or corporation). Include your MI ID number if applicable.

- Provide a description of your business activity and include the NAICS code where indicated.

- Answer the certification questions regarding any exemptions or exclusions. Be thorough with your responses and attach any necessary explanations or itemized lists if applicable.

- After completing all sections, review your entries for accuracy. Ensure all fields are filled as required and make any necessary corrections.

- Save your changes to the form. You may have options to download, print, or share the completed form when done.

Ensure your small business benefits from property tax exemptions by filing your claim online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Senior Citizen, Disabled Person, or Surviving Spouse Age / Disability / Widow/Widowerhood. Citizenship. Income ($10,000 or less annually after permitted exclusions) Property Ownership.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.