Loading

Get 990 Ez Schedule E 2010 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 990 Ez Schedule E 2010 Form online

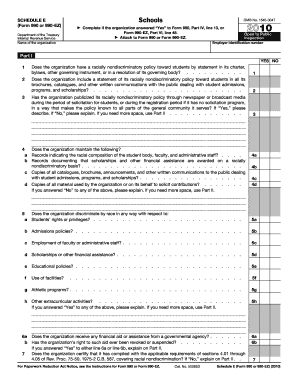

Filling out the 990 Ez Schedule E 2010 Form is an essential task for organizations that serve as private schools and need to report their compliance with nondiscrimination policies. This guide provides a comprehensive walkthrough to help users navigate and complete the form accurately online.

Follow the steps to complete the 990 Ez Schedule E 2010 Form online

- Click the ‘Get Form’ button to obtain the form and open it in your editing software.

- Enter the name of the organization at the top of the form as prompted.

- Provide the employer identification number (EIN) in the designated field.

- Respond to each question in Part I accurately, marking 'Yes' or 'No' as applicable. Make sure to reference your organization's policies and practices.

- For questions requiring explanations, use Part II to provide detailed narratives supporting your answers.

- Review all entries for accuracy and completeness before submission.

- Once satisfied with the filled form, save your changes. You can then choose to download, print, or share the form as needed.

Complete your 990 Ez Schedule E 2010 Form online today for accurate reporting.

If you forgot to file your 990-N, you need to submit it as soon as possible to avoid further penalties. The IRS may impose fines for late filings, and repeated failures can lead to the loss of tax-exempt status. Using resources like USLegalForms can guide you through the filing process to ensure timely compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.