Loading

Get 2011 Ct 104 Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 CT 104 Form online

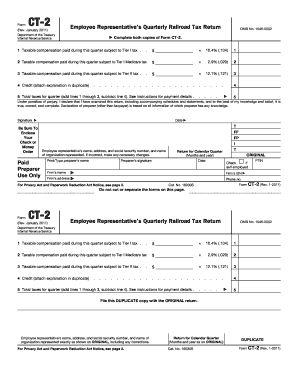

This guide provides a comprehensive overview of how to fill out the 2011 CT 104 Form online. By following these detailed steps, you will be able to accurately complete each section of the form, ensuring compliance with the necessary tax regulations.

Follow the steps to successfully complete the 2011 CT 104 Form online.

- Click ‘Get Form’ button to access the CT 104 Form and open it in your preferred editor.

- Begin by entering your name, address, and social security number in the fields provided. Make sure the information is complete and accurate.

- For line 1, calculate the taxable compensation paid during the quarter subject to Tier I tax. Multiply this amount by 10.4% (0.104) and enter the result.

- For line 2, input the taxable compensation paid during the quarter for Tier I Medicare tax and multiply it by 2.9% (0.029). Enter this result in the designated field.

- On line 3, enter the taxable compensation for Tier II tax and apply the rate of 12.1% (0.121). Record the outcome appropriately.

- If applicable, note any credits on line 4 for overpayments from previous quarters, and attach an explanation in duplicate.

- For line 5, sum the total taxes calculated from lines 1 through 3 and subtract any credits from line 4. This will give you the total taxes due for the quarter.

- Sign and date the form in the appropriate fields to validate your submission. If someone else prepared the form, include their name and information as required.

- Finally, save your changes, and choose to download, print, or share the completed form as needed for your records.

Start completing your documents online today to ensure timely and accurate submissions.

The CT 1040 form is the standard income tax return for residents of Connecticut. It is used to report your income, claim deductions, and calculate your tax obligation. Filing this form accurately is essential for compliance with state tax laws. For more details and ease of access, US Legal Forms provides helpful forms and templates, including the 2011 Ct 104 Form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.