Loading

Get Form 8886 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 8886 2010 online

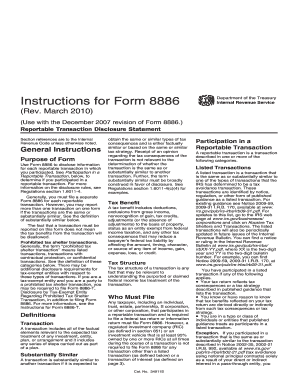

Filling out Form 8886 is a crucial step for individuals and entities involved in reportable transactions. This guide provides clear, step-by-step instructions to ensure a smooth online filing process, whether you have legal experience or not.

Follow the steps to fill out Form 8886 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Carefully read the general instructions provided in the form to understand its purpose and the disclosure requirements for reportable transactions.

- Fill out the required fields such as your name, tax identification number, and the type of entity you represent.

- Indicate the type of reportable transaction by checking the appropriate boxes based on the definitions provided in the instructions.

- List all individuals and entities involved in the transaction, providing names, identification numbers, and their roles.

- Review all entries for accuracy and completeness before saving changes.

- Once completed, save the form for your records, and download, print, or share it as necessary.

Ensure compliance by filling out Form 8886 online today.

Filing Form 8865 involves gathering all relevant information about your foreign partnership interests. You will need to complete the form by providing details about the partnership, including your share of income. This process can be intricate, but platforms such as uslegalforms can facilitate your filing by providing templates and step-by-step instructions to navigate the requirements effectively.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.