Loading

Get Irs Form 4261

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Irs Form 4261 online

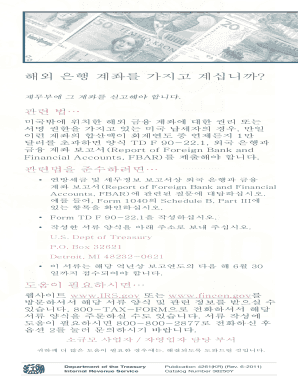

This guide provides step-by-step instructions for users looking to fill out the Irs Form 4261 online. Whether you are managing foreign bank accounts or ensuring compliance with tax regulations, this comprehensive approach will help you navigate the process effectively.

Follow the steps to fill out the Irs Form 4261 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Carefully review the introductory section of the form to understand its purpose and requirements regarding foreign bank accounts.

- Fill in your personal information in the designated fields, including your name, address, and taxpayer identification number.

- Provide detailed information about each foreign bank account, including the financial institution’s name, account number, and maximum balance during the reporting year.

- Confirm your rights or signature authority over the accounts listed. This section is crucial for compliance with federal regulations.

- Review all entries for accuracy and ensure that no information is omitted. It is vital to double-check each section before proceeding.

- Once all the information is complete and accurate, you can save changes, download, print, or share the form using available options.

Complete and submit the necessary documents online to ensure compliance with all relevant tax regulations.

Failing to declare a foreign bank account can lead to significant penalties, including fines and possible criminal charges. The IRS takes non-compliance seriously, and the consequences can be severe. It’s advisable to stay proactive in your reporting to avoid these issues. Consider utilizing IRS Form 4261 to ensure proper declaration and compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.