Loading

Get 2011 Form 8829 Pdf

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2011 Form 8829 Pdf online

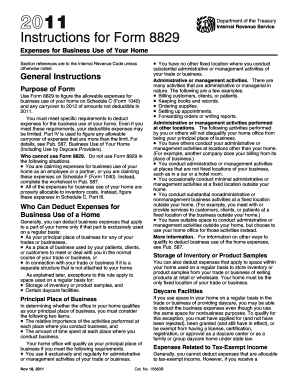

Filling out the 2011 Form 8829 is essential for determining the allowable expenses for the business use of your home. This guide offers clear instructions on each section of the form, making it easier for users to complete the form accurately and efficiently online.

Follow the steps to successfully complete the 2011 Form 8829 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred digital editor.

- Begin by filling out Part I, which requires you to determine the area of your home that is used for business. Enter the total square footage of your home on line 1 and the square footage of the business area on line 2. Be sure not to include any area used for inventory costs.

- Next, calculate your business percentage on line 7, based on the area used for business compared to the total area of your home. This percentage is crucial for determining your expenses.

- Move on to reporting your direct expenses (which benefit only the business part) and indirect expenses (which benefit the entire home) in Part II. Ensure you enter 100% of direct expenses on column (a) and indirect expenses on column (b).

- In Part III, provide details regarding the cost or fair market value of your home, and the land it sits on, for calculating depreciation, if applicable. Ensure you attach any necessary schedules for clarity.

- Complete Part IV if applicable, to determine any carryover amounts for expenses that exceed the limits for the current year. Ensure accurate calculation for potential carryover to the next year.

- Finally, review all entries for accuracy, then save your changes, download the form, print, or share it as needed.

Begin filling out your 2011 Form 8829 online today to ensure proper filing and deductions.

To fill out a PDF tax form, start by opening the document in a compatible PDF reader. You can use tools to add text, check boxes, and signatures where necessary. If you need guidance, consider downloading the 2011 Form 8829 Pdf, as it offers clear instructions. Remember to save your changes before submitting the form.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.